Cash Flow Management: Essential Strategies for Small Business Success

Struggling with cash flow in your small business? Learn practical, easy-to-follow strategies to take control of your finances, prepare for the unexpected, and keep your business thriving.

For many small business owners, cash flow is one of those constant headaches that just won't go away.No matter how great your products, loyal your customers, or ambitious your growth plans, poor cash flow can bring your business to its knees. In fact, cash flow struggles are top reasons many small businesses ultimately fail, leaving even the most promising ventures vulnerable to collapse.

But it doesn’t have to be this way!

By understanding cash flow management and applying a few practical strategies, you can gain control over your finances, be prepared for the unexpected, and keep moving toward your goals. This article explores proven cash flow management strategies, equipping you with practical tools to help thrive in a competitive market.

KNOW YOUR CASH FLOW BASICS

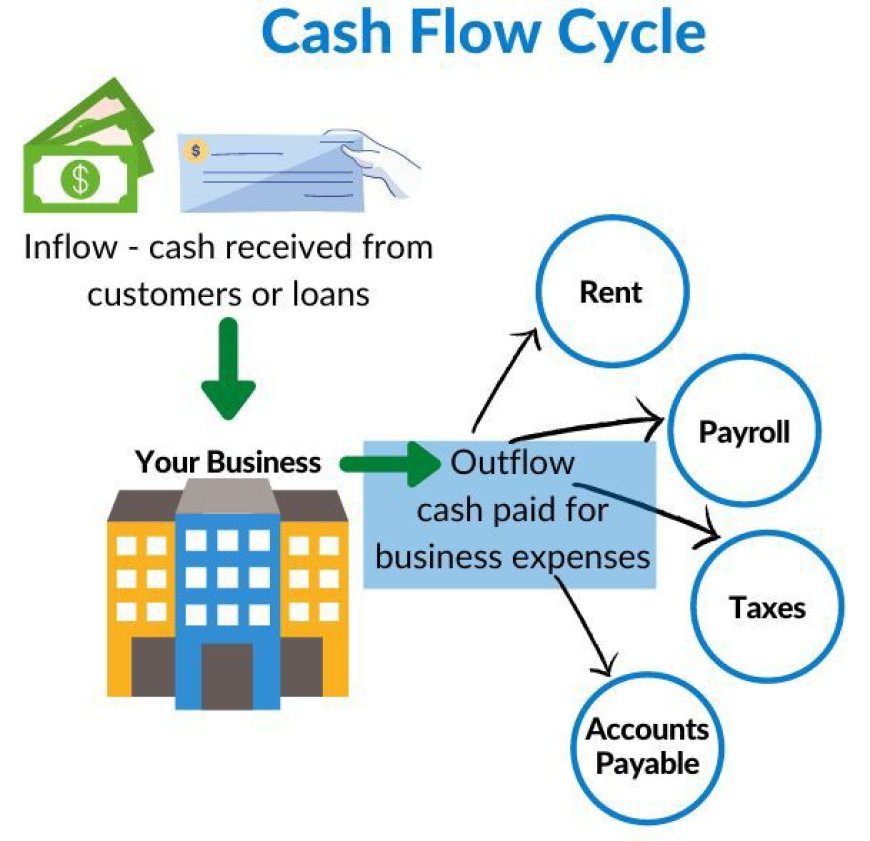

Before diving into strategies, it’s crucial to understand cash flow basics. Cash flow is the money that comes in and goes out of your business over a specific period. Positive cash flow indicates that more money is flowing into the business than out, while negative cash flow signals the opposite.

Types of Cash Flow

- Operating Cash Flow: The core cash generated from regular business operations, such as sales and service revenue.

- Investing Cash Flow: Money used for or earned from investments, like purchasing or selling assets.

- Financing Cash Flow: Cash flow generated from financing activities, such as loans or equity investments.

By understanding these three types, you can begin to forecast cash flow more effectively and identify areas for improvement.

CREATE A SIMPLE CASH FLOW FORECAST

A cash flow forecast is essentially a “money map” for the future. It’s a way to predict how much cash will flow in and out of your business over a specific period (typically a month or quarter). Forecasting isn’t about being 100% accurate; it’s about being prepared. Think of it as a way to spot potential cash shortages before they happen.

How to Create a Cash Flow Forecast

- Review historical data: Examine past income and expenses to identify patterns.

- Project future cash inflows: Estimate expected sales, considering factors like seasonal variations and market trends.

- Estimate future cash outflows: List expected expenses, including fixed costs (rent, salaries) and variable costs (supplies, utilities).

- Update regularly: Check your forecast often to make adjustments as things change.

A cash flow forecast doesn’t need to be overly complex. Even a simple spreadsheet can help you anticipate cash shortages and make informed decisions.

ESTABLISH A CASH RESERVE

Life is unpredictable, and so is business. A client could delay payment, or an unexpected expense might pop up. Having a cash reserve—a small fund set aside for emergencies—can help you manage such situations with little or no stress.

How to Build a Cash Reserve

- Set a small savings goal: Start with an amount that covers at least one month of expenses, then build from there.

- Automate savings: Set up a system to transfer a small percentage of your income to a separate account each month.

- Reinvest wisely: Instead of using all your profits to expand your business right away, put some into this safety net.

Having a cash cushion allows you to handle temporary setbacks or capitalize on growth opportunities without affecting day-to-day operations.

OPTIMIZE ACCOUNTS RECEIVABLE AND ACCOUNTS PAYABLE

Managing receivable accounts (money you’re owed) and accounts payable (money you owe) is crucial for maintaining a healthy cash flow. Late payments from customers can put you in a tight spot, and waiting too long to pay your bills could hurt relationships with suppliers.

Improving Accounts Receivable

- Invoice promptly: Send invoices immediately after providing goods or services.

- Offer incentives: Provide discounts for early payments to encourage timely settlements.

- Follow up consistently: Implement reminders and follow-ups for overdue accounts.

Improving Accounts Payable

- Negotiate terms: Request longer payment terms from suppliers to give your business more time to accumulate cash.

- Prioritize payments: Pay essential bills on time, but negotiate or stagger non-essential payments to balance cash flow.

By balancing your cash inflows and outflows, you’ll avoid those cash crunches that can leave you scrambling.

CONSIDER SHORT-TERM FINANCING OPTIONS

In times of cash shortages, short-term financing options can help bridge the gap. While borrowing can increase expenses through interest costs, using it strategically can offer flexibility when cash flow is tight.

Types of Short-Term Financing

- Line of Credit: Provides access to funds up to a certain limit, which you can draw from as needed and repay with interest.

- Invoice Financing: Allows you to borrow against outstanding invoices, receiving cash sooner while waiting for customers to pay.

- Merchant Cash Advances: Provides an upfront sum repaid through a portion of daily credit card sales, although it often comes with higher fees.

These financing options can be a lifeline during periods of low cash flow, but it’s essential to calculate repayment terms and interest rates carefully to avoid additional financial strain.

DIVERSIFY REVENUE STREAMS

Relying on a single product, service, or client for the bulk of your revenue can be risky. Diversifying income streams not only stabilizes cash flow but also reduces vulnerability to market fluctuations.

Ways to Diversify Revenue

- Expand product/service offerings: Introduce complementary products or services that appeal to existing customers.

- Explore new markets: Target new customer segments or geographic areas.

- Offer subscription services: For businesses with repeat clients, subscription models create predictable revenue and enhance customer loyalty.

A diversified revenue base offers more financial security, ensuring your business can adapt to changes in customer demand or economic conditions.

LEVERAGE TECHNOLOGY FOR CASH FLOW MANAGEMENT

Technology can streamline cash flow management, providing real-time insights into financial performance and reducing human errors. Numerous digital tools and software platforms are designed specifically for cash flow forecasting and monitoring.

Recommended Tools

- Accounting Software (QuickBooks, Xero): Tracks income, expenses, and cash flow automatically, offering reports and insights.

- Cash Flow Forecasting Tools(Pulse or Float): Helps you forecast cash flow, offering visual breakdowns and projections.

- Expense Management Tools (Expensify): Track and categorize expenses to understand where cash is being spent.

These tools are an investment in efficiency, helping you make informed decisions based on accurate data.

KEEP AN EYE ON KEY METRICS

Certain metrics give you a quick health check on your cash flow. By watching these numbers regularly, you’ll notice any red flags early, allowing you to address them before they become problems.

Key Cash Flow Metrics

- Operating Cash Flow: Cash generated by regular business activities—this is your core.

- Current Ratio: Measures your ability to cover short-term obligations; it’s a good indicator of liquidity.

- Days Sales Outstanding (DSO): This shows how fast you’re collecting payments, so you know if receivables are dragging.

GROWTH PLANS SHOULD BE STRATEGIC

Growth often requires investment, which can strain cash flow if not carefully managed. Planning for expansion while maintaining healthy cash flow requires strategic thinking and a phased approach.

Growth Tips

- Scale gradually: Expand in small steps rather than making major investments all at once.

- Use profits for growth: Whenever possible, fund growth with cash from profits rather than loans.

- Check cash flow impacts regularly: Make sure that growth decisions aren’t compromising your cash flow.

Cash flow management isn’t about being a finance expert; it’s about using practical tools and strategies to keep your business running smoothly. By creating a simple cash flow forecast, building a reserve, streamlining payments, exploring financing options, diversifying revenue, leveraging technology, and planning growth thoughtfully, you’ll gain more control over your business’s finances.

In the end, keeping your cash flow healthy helps you focus on what matters—delivering value to your customers, growing your business, and realizing your vision. With these strategies, you’re building not just a financially secure business but a resilient one that’s ready for whatever the future brings.

What's Your Reaction?